Vibrant not Vacant criminal conduct:

The final decision in the San Francisco Prop M Vacancy Tax Case October 31, 2024

As it stands now, the residential vacancy tax is no longer in effect. The city will appeal the decision and debate will continue.

Owners in this property category now don’t need to file or pay any fees to the city. I’ll keep you updated on any future developments.

See the reasons….July 17th Townhall — Stop the Vacancy Tax

Subject: Basics of San Fran Court ruling

To: Chamber Board of Directors, media and interested citizens:

The Court in San Francisco ruled this week against that City on Measure M granting the plaintiff’s summary judgement. That measure is similar to our Measure N enough that it is obvious that Measure N would face a similar fate. That City will most likely appeal. The basics of the judge’s ruling were just as we had pointed out about Measure N. The basics of the ruling are as follows:

1. The Takings and Due Process Clauses of the Constitution Bar the City from Forcing Property Owners to Rent Out Their Property, and the City Cannot Indirectly Coerce the Same Result by Burdensome Taxation.

2. Prop M Is Also Preempted by the Ellis Act.

3. Proposition M Unconstitutionally Disadvantages a Property-Owner’s Choice to Use His or Her Property to House Family Members, in Violation of Due Process and Equal Protection.

4. Proposition M Also Unlawfully Burdens Constitutionally Protected Privacy Interests.

It is unfortunate that our community has been divided against itself over a measure that never should have been started in the first place.

Duane Wallace CEO

This is a recording of the Vacancy Tax proponents web presentation 07/28/24.

In the first 3 minutes of the interview, Ms. Creegan and the interviewer show us two of the 101+ Reasons to vote NO Vacancy Tax. “Scary” (#58, @1:29 ) and Confusing (#98, watch her @ 2:11.

THE VACANCY TAX IS NOT A TAX ON SECOND HOMEOWNERS, IT IS A TAX ON ALL HOMEOWNERS.

Every homeowner would be required to prove that they occupied their own home more than 182 days per year or be subject to the $6,000.00 penalty.

David Jinkens is first SLT City Council candidate to speak out against the Vacancy Tax

If you are second homeowner, you should do the following as soon as possible:

1. Re-register to vote now in South Lake Tahoe (El Dorado County). You can re-register online at www.registertovote.ca.gov. (California Secretary of State’s Office)

2. You can also re-register with the El Dorado County Elections Department. If questions, you can also contact the Assistant Registrar of Voters for El Dorado County: Linda Webster at linda.webster@edcgov.us or 530.621.7483.

The principal requirement for registering to vote in South Lake Tahoe is that your second home in South Lake Tahoe becomes your principal place of residence, that is, your “domicile”. Questions regarding this matter should be directed to the El Dorado County Registrar of Voters as noted above.

Below is how to attend remotely:

Do property owners have the right to decide how to use their property?

The Fifth Amendment of the U.S. Constitution provides that “No person shall be … deprived of life, liberty or property without due process of law; nor shall private property be taken for public use, without just compensation.”

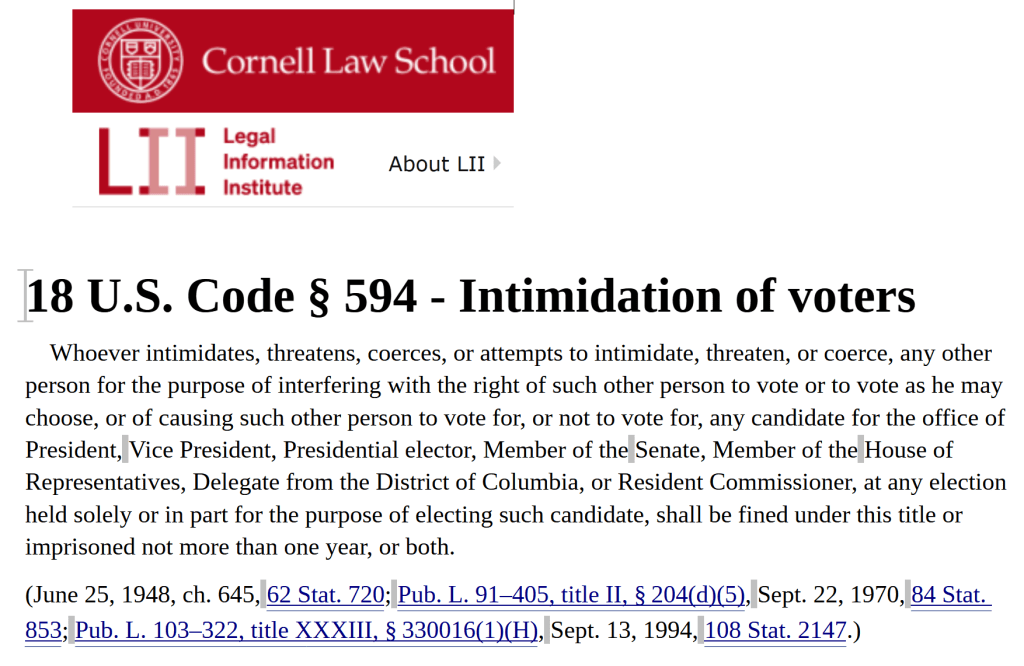

Anyone being harassed about registering to vote in SLT, please take note, they are breaking the law by intimidating you.

Intimidation of Voters

Every person who makes use of or threatens to make use of any force, violence, or tactic of coercion or intimidation, to induce or compel any other person to vote or refrain from voting at any election or to vote or refrain from voting for any particular person or measure at any election, or because any person voted or refrained from voting at any election or voted or refrained from voting for any particular person or measure at any election is guilty of a felony punishable by imprisonment pursuant to subdivision (h) of Section 1170 of the Penal Code for 16 months or two or three years. (§ 18540(a).)

Every person who hires or arranges for any other person to make use of or threaten to make use of any force, violence, or tactic of coercion or intimidation, to induce or compel any other person to vote or refrain from voting at any election or to vote or refrain from voting for any particular person or measure at any election, or because any person voted or refrained from voting at any election or voted or refrained from voting for any particular person or measure at any election is guilty of a felony punishable by imprisonment pursuant to subdivision (h) of Section 1170 of the Penal Code for 16 months or two or three years (§ 18540(b).)

Uncle Sam says, “The proposed South Lake Thoe Vacancy Tax is downright Un-American

South Lake Tahoe Taxpayers Association argument that the Vacancy Tax measure is improperly presented as a ballot initiative “beyond the power of the voters”. What they have done, is to create a “special tax district” consisting of only “vacant homes”. Special districts are only created by a vote of only the property owners.

Official Results for VT Signature Count

FULL TEXT OF BALLOT MEASURES SLT, SF, BERK, OAK

South Lake Tahoe Vacancy Tax Measure Text

San Francisco Vacancy Tax Measure Full Text

SF Vacancy Tax pleadings

In response to a threat direct threat to their financial well-being, the San Francisco Apartment Association, the San Francisco Association of Realtors, the Small Property Owners of San Francisco Institute and four independent owners sued in February, contending, reports the San Francisco Chronicle, that the proposition “violates their right to keep their property vacant and is an unconstitutional confiscation of their property.”

Berkely Vacancy Tax Measure M Full Text

THE VACANCY TAX MEASURE FAILED TO MAKE ANY SIGNIFICANT CHANGE

2024-02-27 WS Item 01 Berkeley Economic Dashboards.pdf (berkeleyca.gov)

Oakland Vacancy Tax Measure W Full Text

Measure N, City of Santa Cruz Empty Home Tax – Santa Cruz Local